In a strategic move, Warren Buffett’s Berkshire Hathaway has recently made notable shifts in its investment portfolio. The conglomerate exited its positions in General Motors and Activision Blizzard, with the sale of the 22 million shares in General Motors being particularly noteworthy, valued at approximately $850 million. The sale of over 14.6 million shares of Activision Blizzard, valued at more than $1.2 billion at the end of the second quarter, also marked a significant move for the firm. On the flip side, Berkshire revealed a new position in Sirius XM Holdings, acquiring about 9.7 million shares valued at just under $44 million. Another interesting addition to Berkshire’s portfolio is the purchase of around 225,000 shares of Atlanta Braves Holdings, reflecting a diverse set of investment decisions. Additionally, Buffett increased his stake in Liberty Media by more than 16 million shares, bringing the total position’s estimated worth to $2.6 billion. While the conglomerate made adjustments upward in certain holdings, such as Liberty Media, it also made significant trims, reducing its position in HP by about 18 million shares and selling off around 13 million shares of Chevron Corp. and 500,000 shares of Amazon. These strategic moves offer insights into Berkshire’s evolving investment strategy and its response to changing market dynamics, providing investors with valuable information as they navigate the complex world of finance.

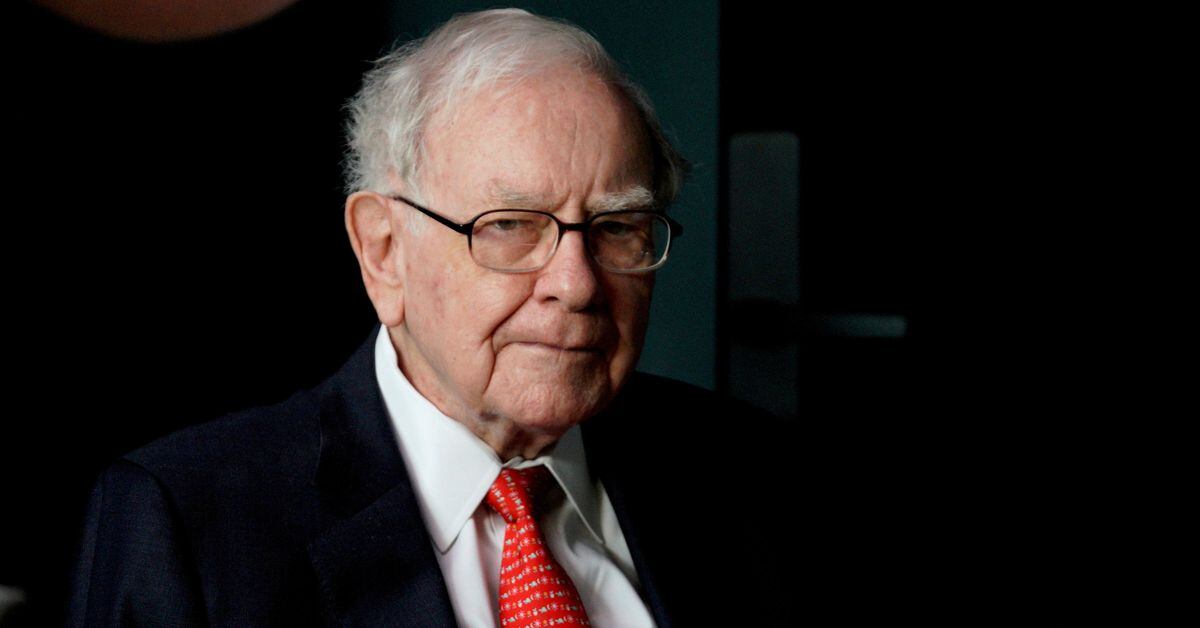

“Buffett’s Investment Shuffle: Berkshire Exits GM, Enters MLB, and Adjusts Holdings in Q3 Portfolio Moves”